Do You Charge Sales Tax On Labor In Kansas . Many services are subject to kansas’s 6.5% state sales tax rate: All retail sales of goods and services are considered taxable unless specifically exempt. It’s your responsibility to manage the taxes you collect. Labor services of installing or applying tangible personal property is subject to sales tax (as a general rule). Any sales tax collected from customers belongs to the state of kansas, not you. Kansas sales tax generally applies to the following types. The current state sales tax rate. Therefore, for every sale of merchandise or. The sales tax rate in kansas consists of two parts — the state sales tax rate and any applicable local sales tax rates. Unless an item is specifically exempt, sales and rentals of tangible personal property are subject to kansas sales tax.

from wichitaliberty.org

All retail sales of goods and services are considered taxable unless specifically exempt. Many services are subject to kansas’s 6.5% state sales tax rate: It’s your responsibility to manage the taxes you collect. The current state sales tax rate. The sales tax rate in kansas consists of two parts — the state sales tax rate and any applicable local sales tax rates. Kansas sales tax generally applies to the following types. Therefore, for every sale of merchandise or. Labor services of installing or applying tangible personal property is subject to sales tax (as a general rule). Unless an item is specifically exempt, sales and rentals of tangible personal property are subject to kansas sales tax. Any sales tax collected from customers belongs to the state of kansas, not you.

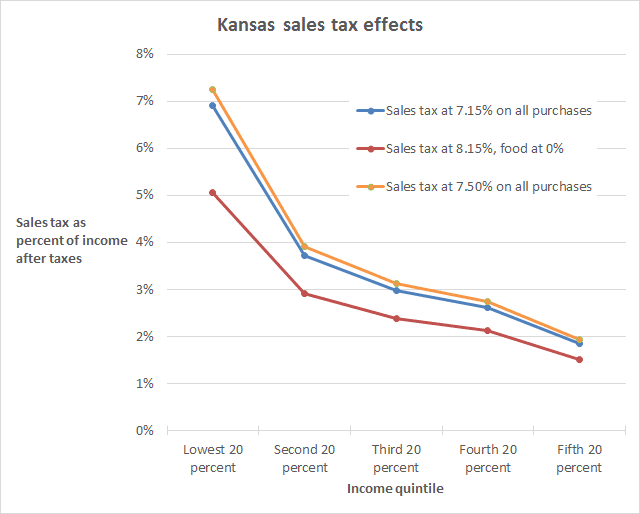

Kansas should adopt food sales tax amendment

Do You Charge Sales Tax On Labor In Kansas Many services are subject to kansas’s 6.5% state sales tax rate: Therefore, for every sale of merchandise or. Many services are subject to kansas’s 6.5% state sales tax rate: It’s your responsibility to manage the taxes you collect. All retail sales of goods and services are considered taxable unless specifically exempt. The current state sales tax rate. The sales tax rate in kansas consists of two parts — the state sales tax rate and any applicable local sales tax rates. Any sales tax collected from customers belongs to the state of kansas, not you. Labor services of installing or applying tangible personal property is subject to sales tax (as a general rule). Kansas sales tax generally applies to the following types. Unless an item is specifically exempt, sales and rentals of tangible personal property are subject to kansas sales tax.

From www.formsbank.com

Form K40 Kansas Individual Tax And/or Food Sales Tax Refund Do You Charge Sales Tax On Labor In Kansas Kansas sales tax generally applies to the following types. All retail sales of goods and services are considered taxable unless specifically exempt. Therefore, for every sale of merchandise or. It’s your responsibility to manage the taxes you collect. Labor services of installing or applying tangible personal property is subject to sales tax (as a general rule). The sales tax rate. Do You Charge Sales Tax On Labor In Kansas.

From www.youtube.com

Kansas Department of Labor announces steps to stop identity theft Do You Charge Sales Tax On Labor In Kansas The current state sales tax rate. Therefore, for every sale of merchandise or. Any sales tax collected from customers belongs to the state of kansas, not you. All retail sales of goods and services are considered taxable unless specifically exempt. Kansas sales tax generally applies to the following types. Many services are subject to kansas’s 6.5% state sales tax rate:. Do You Charge Sales Tax On Labor In Kansas.

From okcredit.com

Should States Charge Sales Tax To Online Business? Do You Charge Sales Tax On Labor In Kansas The sales tax rate in kansas consists of two parts — the state sales tax rate and any applicable local sales tax rates. Many services are subject to kansas’s 6.5% state sales tax rate: Therefore, for every sale of merchandise or. All retail sales of goods and services are considered taxable unless specifically exempt. Unless an item is specifically exempt,. Do You Charge Sales Tax On Labor In Kansas.

From www.signnow.com

Kansas Tax S 20212024 Form Fill Out and Sign Printable PDF Template Do You Charge Sales Tax On Labor In Kansas All retail sales of goods and services are considered taxable unless specifically exempt. Kansas sales tax generally applies to the following types. Any sales tax collected from customers belongs to the state of kansas, not you. Labor services of installing or applying tangible personal property is subject to sales tax (as a general rule). The current state sales tax rate.. Do You Charge Sales Tax On Labor In Kansas.

From www.parahyena.com

Cis Invoice Template Subcontractor Do You Charge Sales Tax On Labor In Kansas All retail sales of goods and services are considered taxable unless specifically exempt. The current state sales tax rate. Any sales tax collected from customers belongs to the state of kansas, not you. It’s your responsibility to manage the taxes you collect. Unless an item is specifically exempt, sales and rentals of tangible personal property are subject to kansas sales. Do You Charge Sales Tax On Labor In Kansas.

From www.patriotsoftware.com

Sales Tax Laws by State Ultimate Guide for Business Owners Do You Charge Sales Tax On Labor In Kansas All retail sales of goods and services are considered taxable unless specifically exempt. Any sales tax collected from customers belongs to the state of kansas, not you. Labor services of installing or applying tangible personal property is subject to sales tax (as a general rule). Many services are subject to kansas’s 6.5% state sales tax rate: Kansas sales tax generally. Do You Charge Sales Tax On Labor In Kansas.

From www.pinterest.com

Sales Tax by State Should You Charge Sales Tax on Digital Products Do You Charge Sales Tax On Labor In Kansas Many services are subject to kansas’s 6.5% state sales tax rate: Kansas sales tax generally applies to the following types. It’s your responsibility to manage the taxes you collect. The current state sales tax rate. Therefore, for every sale of merchandise or. Labor services of installing or applying tangible personal property is subject to sales tax (as a general rule).. Do You Charge Sales Tax On Labor In Kansas.

From www.shopify.com

How To Charge Sales Tax in the US A Simple Guide for 2023 Shopify UK Do You Charge Sales Tax On Labor In Kansas The current state sales tax rate. All retail sales of goods and services are considered taxable unless specifically exempt. The sales tax rate in kansas consists of two parts — the state sales tax rate and any applicable local sales tax rates. Any sales tax collected from customers belongs to the state of kansas, not you. It’s your responsibility to. Do You Charge Sales Tax On Labor In Kansas.

From nancyjlynchxo.blob.core.windows.net

Do You Charge Sales Tax On Finance Charges Do You Charge Sales Tax On Labor In Kansas It’s your responsibility to manage the taxes you collect. Any sales tax collected from customers belongs to the state of kansas, not you. The current state sales tax rate. The sales tax rate in kansas consists of two parts — the state sales tax rate and any applicable local sales tax rates. Many services are subject to kansas’s 6.5% state. Do You Charge Sales Tax On Labor In Kansas.

From theactor.ae

Do I Have To Charge Sales Tax For Cleaning Services Do You Charge Sales Tax On Labor In Kansas Any sales tax collected from customers belongs to the state of kansas, not you. Kansas sales tax generally applies to the following types. Labor services of installing or applying tangible personal property is subject to sales tax (as a general rule). Therefore, for every sale of merchandise or. Many services are subject to kansas’s 6.5% state sales tax rate: The. Do You Charge Sales Tax On Labor In Kansas.

From cityofatchison.com

Local Response Resources City of Atchison Do You Charge Sales Tax On Labor In Kansas The sales tax rate in kansas consists of two parts — the state sales tax rate and any applicable local sales tax rates. Kansas sales tax generally applies to the following types. Labor services of installing or applying tangible personal property is subject to sales tax (as a general rule). The current state sales tax rate. Unless an item is. Do You Charge Sales Tax On Labor In Kansas.

From www.taxuni.com

Kansas Sales Taxes 2023 2024 Do You Charge Sales Tax On Labor In Kansas The current state sales tax rate. Any sales tax collected from customers belongs to the state of kansas, not you. The sales tax rate in kansas consists of two parts — the state sales tax rate and any applicable local sales tax rates. Kansas sales tax generally applies to the following types. All retail sales of goods and services are. Do You Charge Sales Tax On Labor In Kansas.

From www.youtube.com

Do I Need to Charge Sales Tax? YouTube Do You Charge Sales Tax On Labor In Kansas It’s your responsibility to manage the taxes you collect. The current state sales tax rate. Any sales tax collected from customers belongs to the state of kansas, not you. Kansas sales tax generally applies to the following types. The sales tax rate in kansas consists of two parts — the state sales tax rate and any applicable local sales tax. Do You Charge Sales Tax On Labor In Kansas.

From storables.com

When Do I Charge Sales Tax For Home Improvements? Storables Do You Charge Sales Tax On Labor In Kansas Many services are subject to kansas’s 6.5% state sales tax rate: Therefore, for every sale of merchandise or. It’s your responsibility to manage the taxes you collect. Kansas sales tax generally applies to the following types. Labor services of installing or applying tangible personal property is subject to sales tax (as a general rule). The sales tax rate in kansas. Do You Charge Sales Tax On Labor In Kansas.

From www.youtube.com

Why We Charge Sales Tax YouTube Do You Charge Sales Tax On Labor In Kansas Any sales tax collected from customers belongs to the state of kansas, not you. The current state sales tax rate. Many services are subject to kansas’s 6.5% state sales tax rate: Kansas sales tax generally applies to the following types. Therefore, for every sale of merchandise or. All retail sales of goods and services are considered taxable unless specifically exempt.. Do You Charge Sales Tax On Labor In Kansas.

From freecashflow.io

Can I charge sales tax on Shopify if I'm not in the US? FreeCashFlow Do You Charge Sales Tax On Labor In Kansas Therefore, for every sale of merchandise or. It’s your responsibility to manage the taxes you collect. All retail sales of goods and services are considered taxable unless specifically exempt. Kansas sales tax generally applies to the following types. The sales tax rate in kansas consists of two parts — the state sales tax rate and any applicable local sales tax. Do You Charge Sales Tax On Labor In Kansas.

From www.youtube.com

Warning about contractors charging sales tax YouTube Do You Charge Sales Tax On Labor In Kansas The sales tax rate in kansas consists of two parts — the state sales tax rate and any applicable local sales tax rates. The current state sales tax rate. Therefore, for every sale of merchandise or. It’s your responsibility to manage the taxes you collect. Kansas sales tax generally applies to the following types. Labor services of installing or applying. Do You Charge Sales Tax On Labor In Kansas.

From www.shopify.com

How To Charge Sales Tax in the US A Simple Guide for 2022 Do You Charge Sales Tax On Labor In Kansas Kansas sales tax generally applies to the following types. Many services are subject to kansas’s 6.5% state sales tax rate: The current state sales tax rate. It’s your responsibility to manage the taxes you collect. Therefore, for every sale of merchandise or. Unless an item is specifically exempt, sales and rentals of tangible personal property are subject to kansas sales. Do You Charge Sales Tax On Labor In Kansas.